It takes very long to obtain the right domestic to have your, and it also requires numerous excursions regarding the area to view various societies and leases. While you are looking to purchase property that have a mortgage, you’re going to have to experience yet another round of conferences on lender, that include numerous layers out of paperwork and you can records. Henceforth, House Earliest Monetary institution features digital alternatives yourself mortgage classification so you’re able to express the entire process of applying for a good financing.

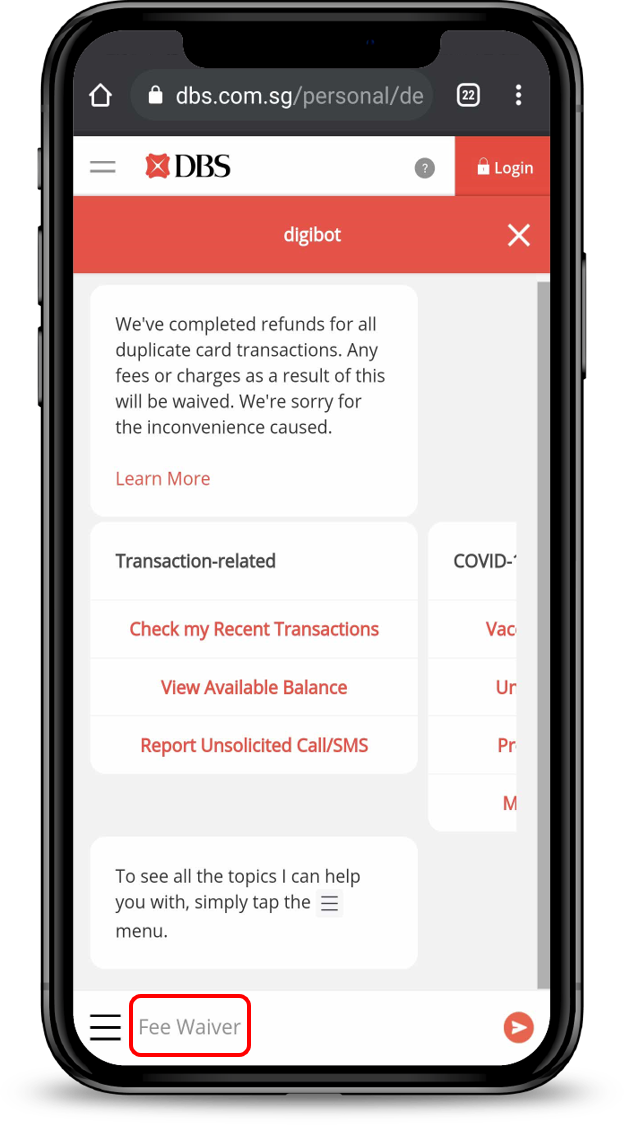

Household Very first Finance company activities Express Loans to make the loan processes brief and you may straightforward. It’s easy to sign up for home financing on the web in the any moment and you will off people area.

After you fill out your application on the web, you will discover punctual recognition. HomeFirst enables https://paydayloansconnecticut.com/guilford-center/ you to get that loan approve within just 5 simple actions. The service offers a preliminary Sanction Letter, about what you could see financing.

1: Verify your bank account | 2: Speak about your revenue facts | 3: Establish your home information | Step 4: Bring the email address | Step 5: Get financing render

Attributes of HomeFirst Mortgage

- It could be recognized within just a few clicks.

- At present of financing acceptance, no data are essential.

- Finest corporates can enjoy a different sort of handling package.

- The order was paperless, and the entire family application for the loan procedure is carried out on the web.

Qualifications getting Financial

Credit rating/Credit history: Generally speaking, loan providers choose to provide in order to individuals that have credit ratings out of 750 otherwise significantly more than. Including financing applicants possess a far greater odds of providing home loans with minimal interest rates.

Chronilogical age of this new Candidate: Essentially, a decreased decades to apply for home financing was 18 ages, in addition to restrict ages during the time of mortgage maturity is actually 70 age. The pay time is typically up to 3 decades, with several loan providers capping the age of old-age once the limitation age limitation.

Income and you can a career: A top money means a greater capability to pay off that loan, implying a lower risk on financial. Because of their large-income predictability, salaried staff typically have a much better likelihood of obtaining mortgage loans from the straight down interest levels.

Fees Ability: Banks and you can HFCs commonly accept home loans in order to applicants whoever entire EMI connection, such as the suggested financial, doesn’t surpass fifty% of the complete money. Because the opting for a lengthier financing several months reduces the domestic loan EMI, persons with lower mortgage eligibility can also be most useful their disease of the going for an extended tenure.

Property: Whenever determining house financing eligibility, lenders consider the property’s health, strengthening characteristics, and you may ount that can be considering into property. The most a lender could offer toward a construction loan cannot exceed ninety per cent of your property’s worthy of, based on RBI guidance.

Documents Required

To obtain a mortgage, an applicant must provide plenty of records setting up their KYC, brand new antecedents of the property they attempt to buy, the money background, and stuff like that, based on and that customers group it belong to (salaried/professional/businessman/NRI).

Brand new files expected is different from that bank to the next. Allow me to share a few of the most normal documents you’ll need for a home loan in the India.

Tips Use?

In advance selecting your ideal family, you’ll have an idea of how much regarding a home mortgage you would be qualified to receive predicated on your revenue. It will assist you in and work out a monetary wisdom regarding your house you want to to get. You need the mortgage eligibility calculator to choose exactly how much money youre eligible for. Due to the fact possessions might have been accomplished, you may also look at the HomeFirst web site and you will fill in the fresh inquiry means to obtain a visit straight back from a single in our Counsellors. You can read this post for additional information on loan words, otherwise this information to learn about the fresh documents necessary for loan applications.

Into the more than advice at hand, it’s possible to obviously answer the issue from simply how much home mortgage you can to get according to their money and take an enormous action towards getting the fantasy family.