“We have to enhance the an incredible number of property owners against foreclosures,” the guy said on the venture trail from inside the . Their package called for alterations in personal bankruptcy laws, an excellent crackdown towards the predatory and fraudulent loan providers and you may a great $10 million financing to simply help home owners $255 payday loans online same day South Carolina end foreclosure.

Which have Obama looking to re-election in the 2012, their listing on foreclosure crisis try below attack. Brand new Republican group Crossroads GPS told you during the a recently available television offer one Obama bankrupt their vow to help having difficulties homeowners. The fresh new offer suggests Obama stating he’d assist them to after which seal of approval “BROKEN” towards monitor.

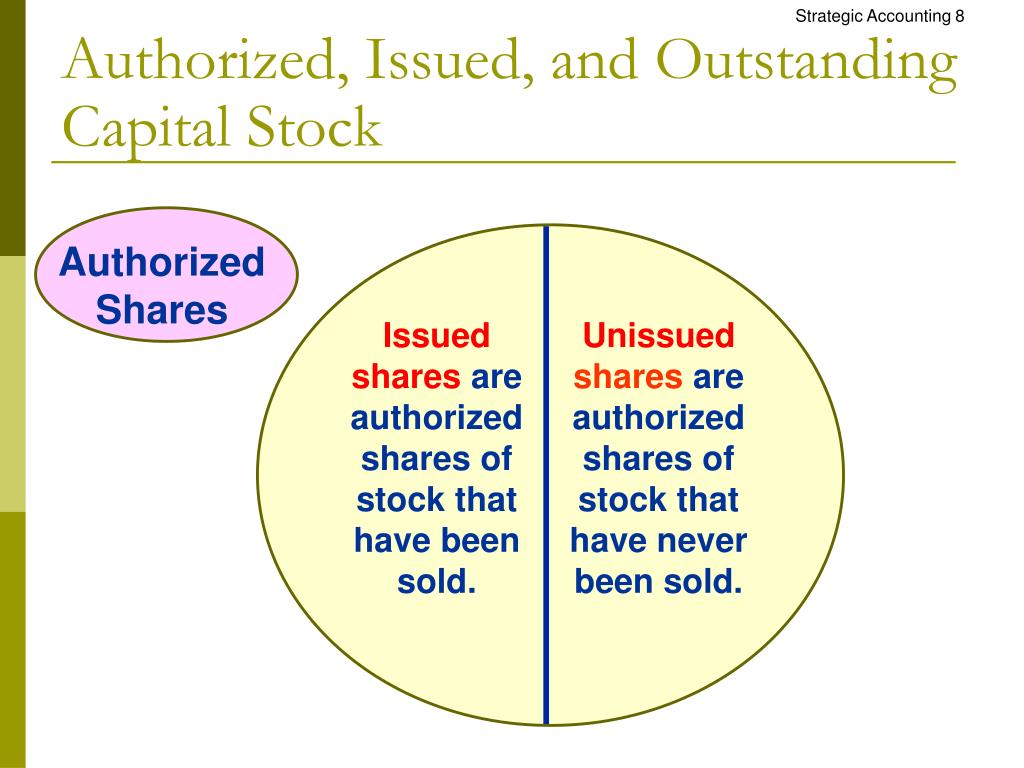

Your house Sensible Re-finance System, or HARP, aligned to help people refinance their loans during the lower interest levels

PolitiFact checked-out new Crossroads claim and found that, in reality, Obama has received limited victory together with his intentions to simplicity brand new mortgage drama.

“I don’t consider you will find much doubt, actually into the administration, the (property foreclosure assistance) apps overpromised and you may underperformed — embarrassingly therefore,” told you Ken Harney, exactly who produces a weekly syndicated a house column.

The outcomes, experts state, have been mixed at the best. Obama themselves says the newest casing drama is one of persistent material he’s faced.

“Whenever we were not a beneficial capitalist savings, it would be so simple,” told you Ken Thomas, a different lender expert and you can economist in the Miami. “The audience is an industry-regulated discount, we’re not a national-managed cost savings. Making it quite difficult toward regulators to-do one thing.”

New Fraud Administration and you can Recuperation Operate, hence Obama closed last year, will make it a federal offense making a beneficial materially not the case statement for the a home loan application or even willfully overvalue a house in order to determine any action by the home financing credit providers. PolitiFact’s Obameter offered that a hope Leftover. And you may brand new conditions getting enabling anyone understand its home loan were incorporated regarding Dodd-Frank economic change enacted this present year, a separate Promise Left.

However, he’s had limited success towards promises that would has actually provided the most significant help to residents, predicated on four masters we interviewed. A temporary foreclosure moratorium happened during the early 2009 as banking companies halted its filings because they waited towards brand new government to find the bundle in place to handle the fresh crisis. It’s not obvious, though, that it at some point left most people from foreclosure.

“That sort of got the brand new wind out from the program, in such a way. In the event it got enacted, it could possess lay much more fire in legs out of the borrowed funds servicers,” told you Alex Schwartz, a teacher regarding urban policy in the Brand new College or university and you will author of your own book Houses Policy in the us. Alternatively, he told you, “you were leftover that have volunteer contribution from servicers.”

Brand new property foreclosure prevention money was one’s heart of their promise. The guy in the first place pledged $10 million but wound-up putting aside $75 billion, having fun with TARP funds. He predicted the bucks create help nine mil home owners.

But immediately following 3 years, only about 2 billion people have acquired permanent home loan assist, according to the Institution from Housing and Urban Invention.

Experts state the change inside the case of bankruptcy laws so that judges so you can customize private funds could have made a big change, but it passed away inside the Congress

Both fundamental software was dubbed HAMP and you may HARP. In Household Affordable Modification System, otherwise HAMP, loan providers was indeed encouraged to reconstitute finance to have individuals who have been struggling to pay. Financial institutions acquired brief payments regarding the government once the incentive.

“Obama’s program try extremely challenging, it absolutely was voluntary, it had been in the a merchandising level, requiring visitors to call-in and work on personal servicers. It had been a mess,” Schwartz told you. (Toward our Obameter, we rated the new foreclosure loans a promise Broken whilst fell far lacking Obama’s goal of providing nine billion home owners.)