In essence, an FHA family evaluation is made to pick any possible problems with the house. The problems extremely flagged by a keen FHA inspector are the ones one to you can expect to twist a risk towards the customers or those who you certainly will twist a critical architectural state, also those who might result from inside the severe harm to the property itself.

Passageway an enthusiastic FHA domestic review is actually much harder than passing other forms regarding inspection reports as if the brand new inspector refers to significant difficulties with the property, the individuals difficulties must be cared for before you can safe a loan. not, in the event the a house is secure, from inside the a repair, and has now no visible dilemmas, you should solution an FHA house inspection fairly effortlessly.

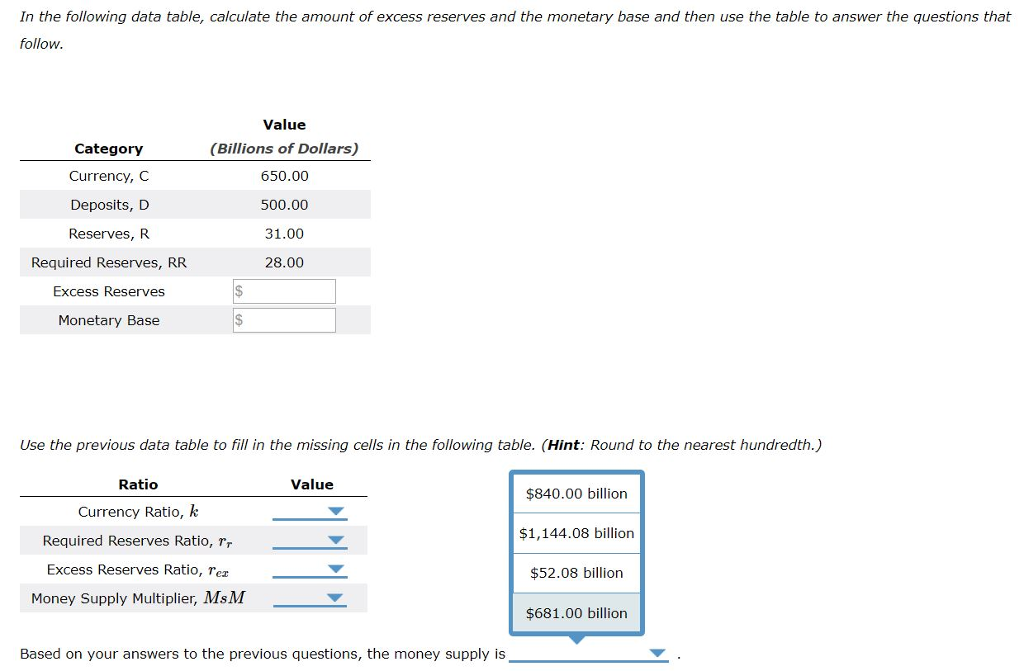

Exactly what will falter an FHA household inspection?

You will find some affairs that may change the power to violation an enthusiastic FHA household examination. Sooner or later, however, you can find three problems that the inspector is seeking. In the event your home inspected drops on one of these about three secret groups, that loan might be denied.

#step 1. Our home was unsafe having habitation somehow.

Of several property are not any longer not harmful to habitation getting an option out of factors. In many cases, an assessment will get know electronic potential risks which will were worked having years back, along with out-of-go out wiring which could imply a significant chances having residents of the home. Other days, their inspector you’ll find severe signs and symptoms of water damage and mold, that may result in mildew and mold accumulation and you may, in the course of time, so you’re able to severe trouble.

Other days, the house years that may even cause it to failure when you look at the the long term. Insects and you can rodents you are going to angle a potent danger, speedycashloan.net open a bank account with no deposit required because they can boost the possibility of disease and you may issues for citizens of the home.

Whether your house is harmful having habitation unconditionally, new FHA inspector might number one inside the need. Often, you to definitely issue is one which the vendors is enhance upwards rapidly, that can get the mortgage approved more readily. Some days, yet not, the newest FHA inspector will get identify a critical hidden disease that could pose a substantial hazard in order to citizens of the house, together with the one that the new suppliers never augment right up without difficulty prior to promoting the house. In that case, the buyer is almost certainly not able to support the financing they’re dreaming about.

#2. The house is actually unsanitary somehow.

Unsanitary lifestyle requirements are risky to your customers of the household, and you can FHA inspectors does not accept those people finance or allow the the home of admission inspection until the items try taken care of.

Rodentsor clear signs of rodent droppingsis a switch illustration of an enthusiastic unsanitary home, just like the was bug infestations. Other problems may include mildew and mold accumulation which will were treated well before otherwise sewage products, together with sewage burning towards the empties to the property.

Often, sanitary activities was easy for the house providers to fix right up, that will to enable our home to take and pass check. Although not, speaking of questions that consumers will have to manage previous to buying the property.

#step three. The home keeps obvious signs of architectural destroy.

Should your household keeps apparent signs of architectural wreck, odds are, its one thing the current homeowners won’t be able to solve up quickly. In the event the house is perhaps not sound, it might failurewhich you will mean big problems for the latest house’s people. Any time a property has apparent architectural troubles, it will not pass FHA inspection.

What portion are looked inside FHA home inspection checklists?

- Brand new rooftop

- The property by itself, as well as each other potential availability activities and you may any potential injury to the assets