When making an application for home financing in Dallas, one of the first facts lenders usually evaluate is the borrowing from the bank rating. This around three-hand matter are a snapshot of the monetary health and plays a crucial role during the choosing the kinds of home loan available options for you. A top credit score implies that you take control of your debts sensibly, make ends meet promptly, consequently they are less likely to default towards the loans. These functions leave you a nice-looking candidate for lenders. This guide have a tendency to explore just how maintaining a powerful credit score is help you secure favorable financial pricing and simpler fee terminology, making sure you possibly can make one particular of your newest Dallas mortgage business conditions.

Market Criteria

Already, Dallas financial costs are experiencing fluctuations. 30-12 months fixed home loan averaging doing 6.938%, a good fifteen-seasons repaired around six.084%, and you may an excellent 5-12 months varying-speed home loan (ARM) at the approximately eight.918%. Such costs were trending right up has just, emphasizing the importance of protecting a speed easily after you discover pre-approval. Despite such rising rates, the new Dallas housing industry remains as effective as escalating home prices and a rigid catalog, to provide both pressures and you may ventures for the markets.

Credit rating Criteria during the Colorado

From inside the Texas, especially in Dallas, extremely loan providers put the minimum credit score to possess traditional funds during the 620, while you are FHA funds should be protected with a credit history because the low due to the fact 580. Achieving a higher credit history is rather improve your likelihood of acquiring greatest interest rates. This may fundamentally connect with their month-to-month mortgage payments and you will complete financing prices.

To have antique financing, an average deposit is just about 20%, however, numerous possibilities give reduce payments. Such as, FHA financing require only a beneficial step 3.5% deposit, and you can Va fund give a great advantage to qualified pros of the demanding zero deposit anyway. These selection make home buying so much more available, particularly for earliest-day consumers americash loans Rye or individuals with shorter offered dollars for upfront will cost you.

Deciding on the best Bank into the Dallas

Navigating this new Dallas mortgage land can be more straightforward into the assistance of regional lenders for instance the Tuttle Classification, who happen to be well-acquainted with industry insights and can aid in optimizing the capital solutions. Such as for instance, the new Colorado Home loan Borrowing from the bank Certificate (MCC) system offered compliment of regional lenders also provide extreme income tax recovery by enabling homebuyers so you can claim a card to possess a portion of its mortgage attract. This work with decrease overall borrowing costs drastically. Also, regional assistance function a far more designed, successful application techniques and you can competitive speed offerings.

To understand more about exactly how your credit score make a difference to the mortgage alternatives in the Dallas also to get a great deal more skills into the current market, imagine signing up for our very own totally free webinar. Here, you’ll receive specialist recommendations tailored into Dallas market, helping you generate advised behavior regarding your family purchase. Check in now and start your journey to homeownership with confidence, equipped with ideal education and you can assistance.

Mortgage Costs Borrowing from the bank Impact Dallas

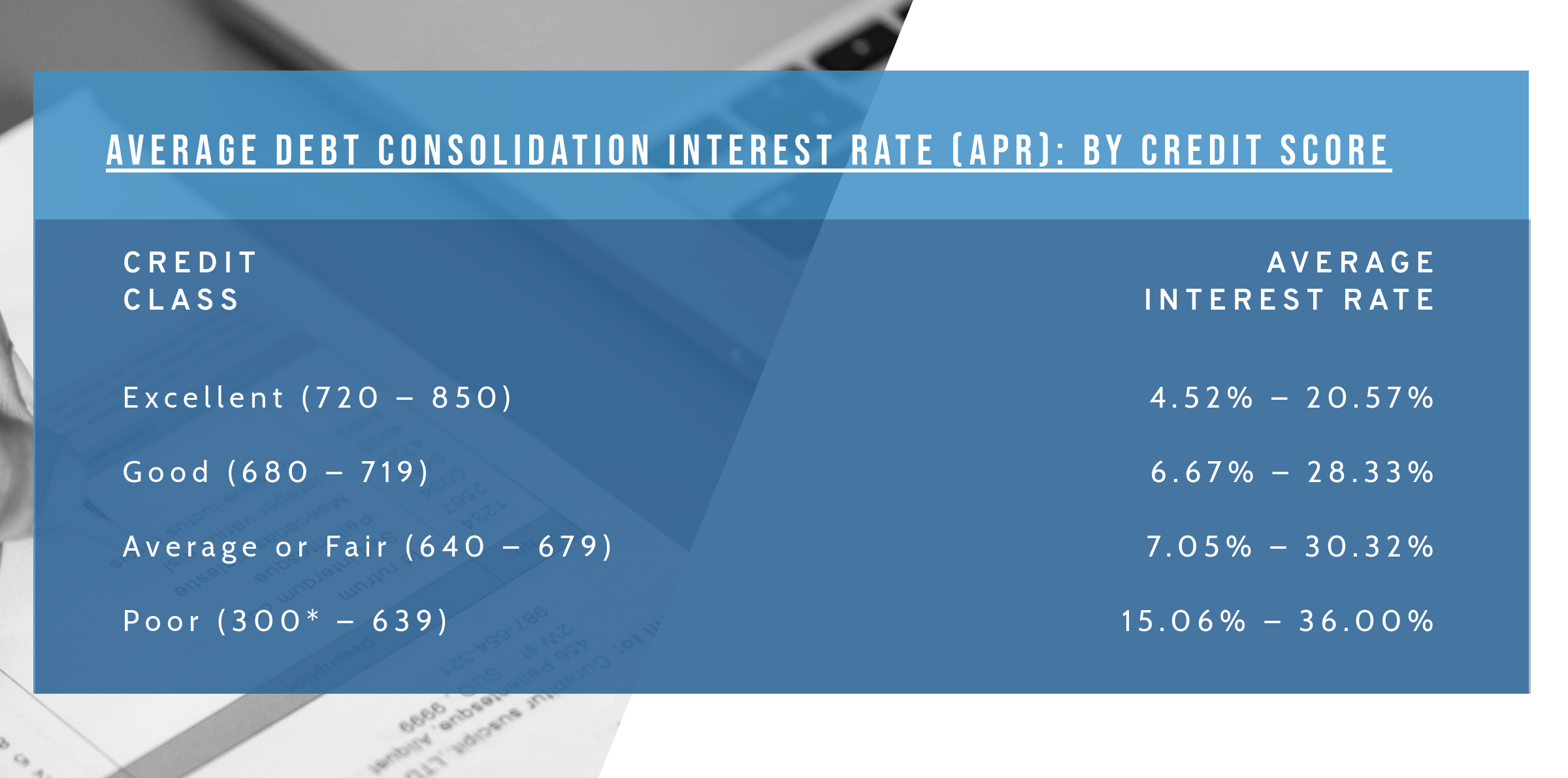

Focusing on how mortgage rates are determined is vital if you find yourself looking to purchase a home for the Dallas. This type of costs depict the expense of borrowing from the bank finance purchasing a beneficial assets and therefore are determined by a variety of financial activities. Generally, the mortgage price try a life threatening feature you to impacts the complete cost of your financial, dictating each other the monthly installments additionally the enough time-title notice you are going to pay.

One of the several determinants of your financial rates you be eligible for is your credit history. A top rating, usually significantly more than 740, makes it possible to hold the absolute best pricing, ultimately causing down monthly installments and you will possibly helping you save thousands more than the life of loan. On the other hand, lower results can result in high cost, and therefore grows the borrowing from the bank will cost you substantially. To own detail by detail tips about improving your financial conditions, explore so it full book.