Benefits associated with RenoFi Money

Before you apply for a financial loan that have good cosigner to help you get more financing, you should know trying to get good RenoFi financing and that allows you to use more funds by credit against the coming property value the possessions article-recovery, in place of borrowing up against the newest well worth.

Think this example: Your home is appreciated on $500,000, that have a home loan equilibrium away from $400,000. You’re planning a restoration and you can desired this new residence’s value increases in order to $640,000 a while later. Currently, your loan-to-worth (LTV) proportion is actually 80%, meaning you cannot obtain any money into renovation not as much as typical financing laws.

A RenoFi financing alter it by permitting a keen LTV of right up in order to 150% or 90% in line with the immediately after-restoration value.

Thus, when you are an elementary house collateral loan provides you with no borrowing from the bank electricity, a beneficial RenoFi mortgage enables you to availableness as much as $176,000 of the leverage the house’s upcoming worth.

If you’re considering a home restoration and want an excellent HELOC that provides you with deeper borrowing from the bank strength, exploring RenoFi’s selection could be the best provider for your requirements.

Discussions On the Cosigner

A beneficial cosigner can get diving during the possible opportunity to help you, even so they want to know what they are delivering themselves on.

When they not really acquainted with the procedure of bringing a good domestic guarantee loan, they want to create the look before generally making people pledges. Nonetheless they must completely understand their role since cosigners and you will just how agreeing to-be one could impact the most recent and you will coming state of the credit file.

It’s adviseable to feel initial with your cosigner exactly how your decide to deal with the brand new repayment words and you will determine as to the reasons you happen to be asking all of them in the first place.

Instance, what if you reside a remote town no social transport, as well as your vehicle can be your best way to access and you may off works. For many who clean out your own vehicle, you reduce your work otherwise experience the expense out-of a rental.

Your current credit history is ok although not higher, and you also become utilizing your latest household guarantee will allow you to find an established, safer, like-the brand new vehicle to get in order to for which you have to wade. This new cosigner should become aware of this. cash advance loans installment Washington bad credit You may want to feel vulnerable asking for help and you may revealing extreme, personal statistics, but some some one (rightfully) need to know this particular article before generally making such as a life threatening financial choice.

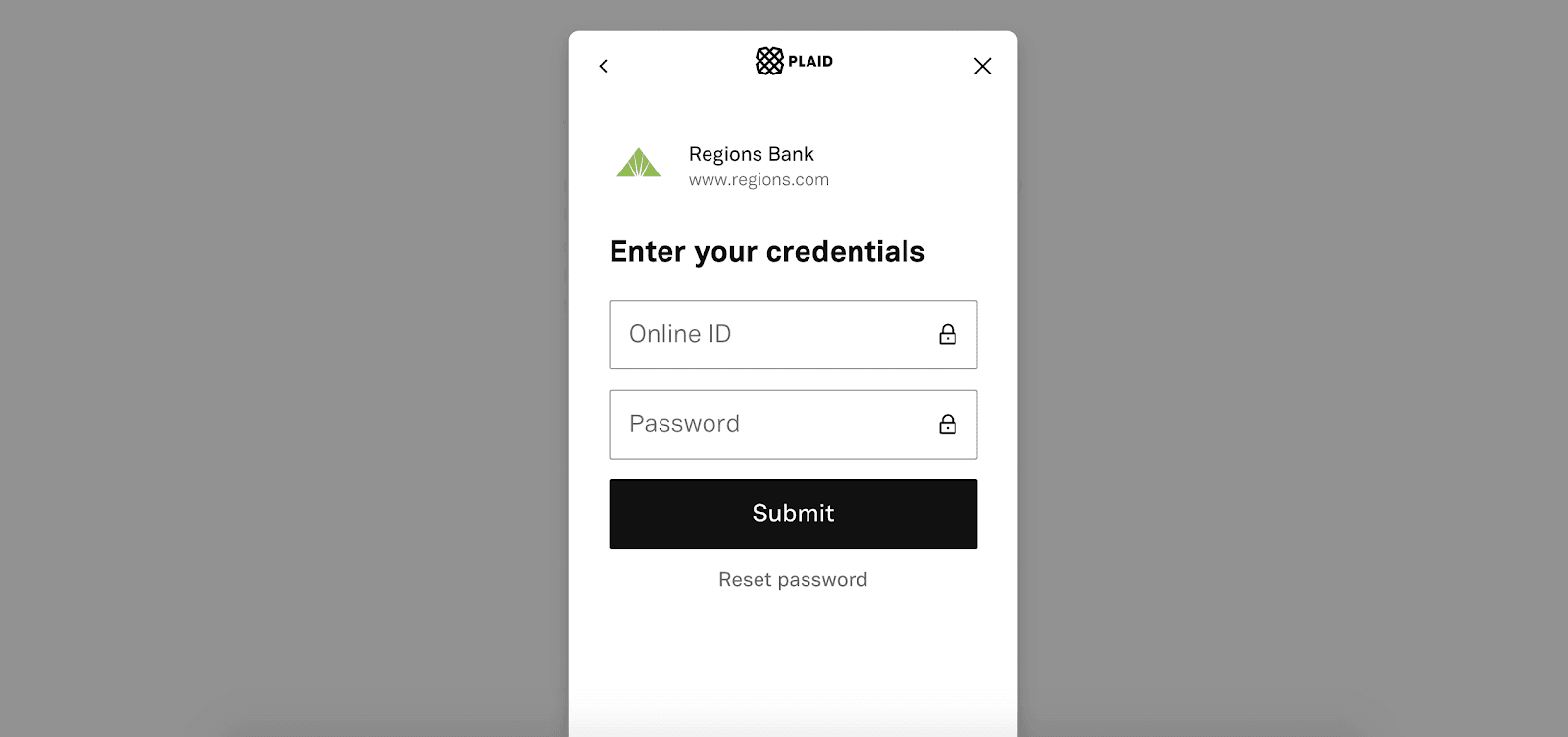

Due to the character they might be joining, the newest cosigner ought to be an integral part of the choice-and make process from the and this financing you’re going to get and lender it is possible to work with. At the same time, whether or not you keep in touch with the lender for the phone or in person or you incorporate on the internet, this new cosigner should be present in situation he’s any queries prior to it formally to visit.

Tips for Contrasting Loan providers

There is lots to take into consideration when deciding on a house guarantee financial. What is important to consider is the lender’s profile. It could be enticing to go with a name you will be not familiar that have once they create loads of claims, but it’s usually better to team up having a lender whom has an effective profile and additionally be truthful along with you throughout the your situation as opposed to providing you incorrect pledge or making unsubstantiated promises.

You should also look into whom has the benefit of cost conditions, for instance the schedule and interest rates, that you find comfortable agreeing so you’re able to should you qualify for the fresh house guarantee loan.

Probably one of the most vital what to listen to when you’re doing your research is actually making certain the lending company will bring obvious and you can to the point loan conditions which might be easy to understand, such as for example towards the RenoFi Domestic Equity Loan.