Shreya got aside an unsecured loan of their particular financial in check first off her own couture company. The business is doing an excellent option for the initial month or two, but then started to impede. Insufficient normal consumers led to nothing cash age group. As a result managed to get extremely hard to have their unique to keep purchasing their own Personal loan EMIs, and ultimately she defaulted on the mortgage.

Although defaulting or otherwise not spending several EMIs is not demanded, but sometimes due to factors away from handle, you may not be able to pay them.

What goes on if you find yourself inside the defaulter?

However some financial institutions or other money lending associations provide versatile policy arrangements, very dont and take action. Just like the Unsecured loans don’t require you to definitely set up one equity facing them, defaulting with it commonly be open resulted in pursuing the some thing happening:

Enhanced rate of interest

Into defaulting on your own EMIs, the financial institution fundamentally increases the interest rate towards loan and/or levies a lot more charges and you may charge in your loan.

Straight down CIBIL get

Every banking institutions and you may NBFCs report failed money and you will credit card fee defaults so you can credit bureaus for instance the CIBIL and Equifax. And this, yourCIBIL scorewill end up being affected negatively. Do not need it softly and you can neglect it, whilst requires a lot of effort so you’re able to reconstruct your own borrowing from the bank rating.

Collection agencies

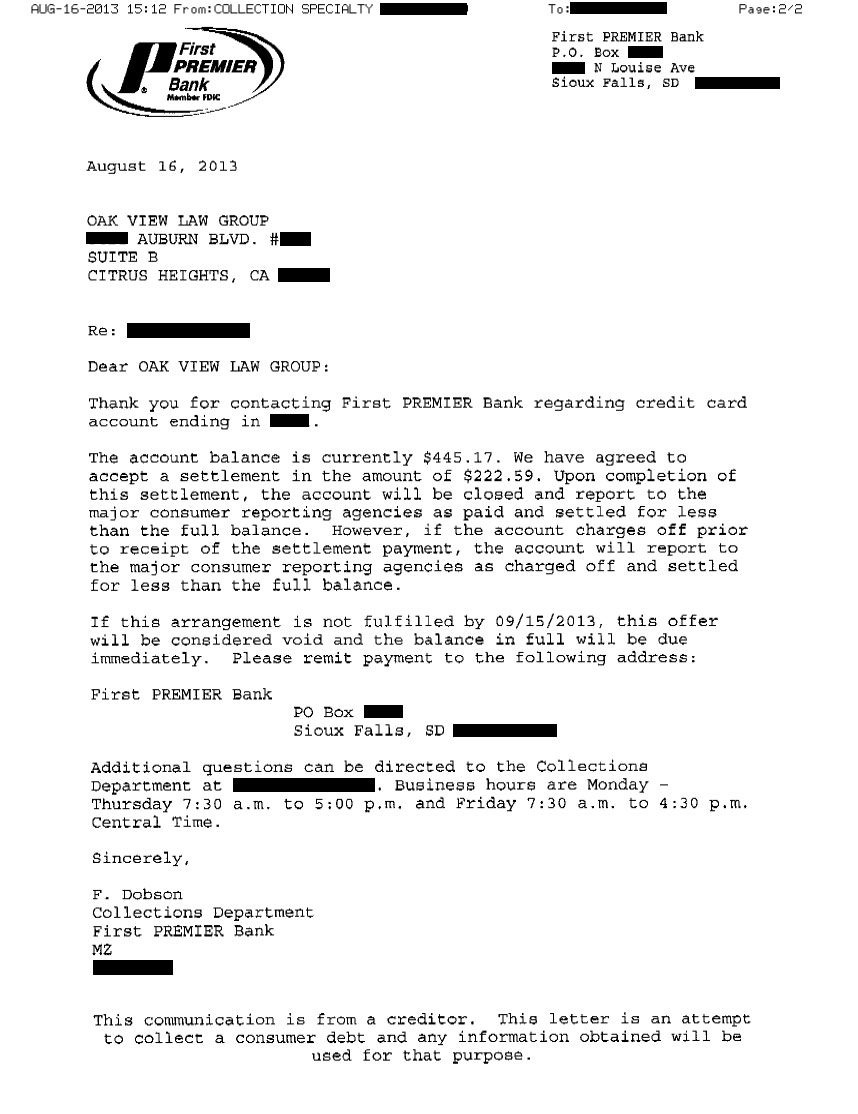

Finance companies or other NBFCs possibly check out collection agencies to get back their money. This type of businesses you are going to call you, develop your letters or create a home head to.

Your own co-signer or guarantor suffers

You are not alone exactly who confronts the latest force from defaulting given that their co-signer and you can/otherwise guarantor’s fico scores also grab a knock. As well, they as well located calls and check outs by financing healing agencies during the buy to recuperate the loan amount.

Suit of the banking companies and you may NBFCs

There had been cases where loan providers has actually chosen some court paths with a standpoint to recuperate money from personal loan defaulters.

Rectifying the debt

Should you end up defaulting on the financing, don’t be concerned. You might give oneself out of one to situation if you take new following steps:

Do not stress

We understand defaulting for the that loan could become exhausting. That’s why, start off with quietly determining your own cost and you can insights what added compared to that condition.

Correspond with the lending company

Talking to the financial institution can sometimes works secret. Show all of them why/ and you may around exactly what circumstances your defaulted and then try to work out a remedy that helps the two of you.

Believe refinancing

Refinancing gives you the capability to lower your month-to-month EMI matter. Yet not, extremely banking companies just imagine people who have a good credit score ratings having refinancing.

Origin a lot more income otherwise scale back

Come across ways to generate extra income by firmly taking up a preliminary-title occupations. If it is not a practical choice, was cost management the monthly expenses to keep many pay-off the other personal debt.

What happens if Personal loan Maybe not Paid off?

Something could go most bad if you don’t repay their personal loans promptly. This can has actually a big impact on your finances and you may credit get.

A different sort of problem with failing to pay straight back that loan is that you are charged late fines to possess forgotten repayments. These types of charges accumulates rapidly and end up in a whole lot larger troubles in the future. In addition, you are in danger of getting the loan gone to live in another type of personal installment plan for individuals who prevent spending on time. When you are going through a pecuniary hardship, following this could be a highly payday loan Wilsonville bad question.

If you are considering taking right out an unsecured loan, it is important to take time to know what they means to pay back the borrowed funds entirely every month and just how much you will be charged. Furthermore, you must know the potential charges that consumer loan defaulters might need to face.