Earlier considering characteristics, you really need to affect lenders to track down recognition from inside the principle’. This means you realize if you will rating home loan acceptance and how much cash you might obtain. It might be a benefit to fully grasp this in terms to making an offer to the property.

You are able to the mortgages Currency Tool to see the new items out of mortgage loans as well as the rates that are available of most of the of main lenders for the Ireland.

What is the finest sort of mortgage safeguards insurance coverage?

When you are making an application for home financing, there are what need within our currency centre. You could contrast the choices playing with our very own mortgage loans Currency Unit if you are curious if you would certainly be best off having a good more home loan.

This week, Eoin was requested when the banking institutions believe a customer’s credit history when obtaining a mortgage. If you find yourself Irish banks don’t use fico scores, you should know of your credit history and how banking institutions will appear during the they.

Answering their mortgage questions

Mortgages are often the largest monetary product we will remove. See just what visitors to the money Clinic wished to find out about in terms of mortgages.

Deciding to make the application

- using directly to a lender and seeking pursuing the application procedure on your own.

- playing with a large financial company who’ll deal with lenders on the part and you can give you advice during the processes. You really need to inquire a broker for their Regards to Business’, which shows whatever they charge as well as how of many loan providers it portray.

- proof of ID, proof of address and proof of your own personal Public service Count (PPSN)

- proof of income: current staff outline summation away from Funds, payslips, specialized levels when the self-operating

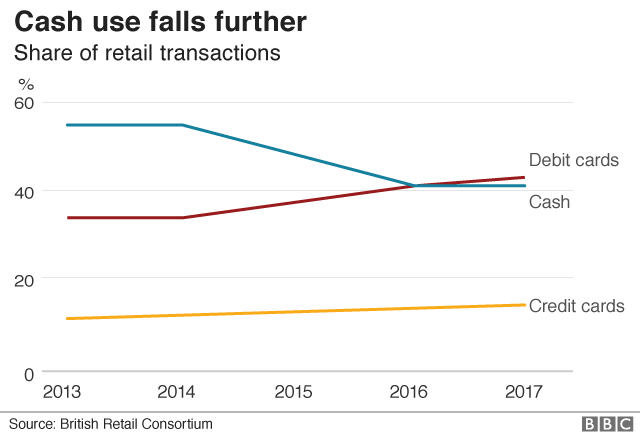

- evidence of the manner in which you control your currency including most recent membership and you will mastercard comments

You will want to apply to multiple loan providers and you can evaluate the prices and you may has the benefit of meticulously. Avoid being lured from the introductory even offers, particularly cashback otherwise free judge expenditures. These can getting rewarding on brief-label, however, one mortgage could end upwards costing you even more when it keeps a higher rate of interest.

What do loan providers legs its choice with the

- earnings lenders look at your annual earnings and some usually takes bonuses and you will overtime into consideration. Particular may also reason for local rental earnings if you plan to help you rent out a space

- years how old you are now, how old you will be after you retire and you will/otherwise if the home loan comes to an end

- a great finance if you have most other finance otherwise a top credit card harmony it ount you could potentially acquire otherwise can affect your capability to rating home financing

- employment reputation are you currently for the long lasting work, a short term bargain or with the probation

What direction to go while accepted

Lenders bring recognition inside the principal’ that is a statement regarding simply how much it will be ready to lend you. Good page from offer’ is what you’ll located in the event the financial has been totally accepted, while simply get this to shortly after your own bring with the a house has been acknowledged.

Mortgage approval is just valid getting a particular months, typically away from half a dozen so you can 12 months, according to their financial. You should mark the americash loans Anderson loan down up until the expiration day. If not, you usually need certainly to implement once more. The speed into the home loan is decided at the time the money is actually taken down, it would be different to the speed revealed in your home loan approval.

Research rates for the mortgage safety and homeowners insurance when you is actually obtaining home financing. Remember that you don’t have to purchase such from your mortgage supplier even though they may offer all of them.