Age try a senior Posts Selling Director with over a decade of expertise on the planet. That have authored or edited 1,000+ on line content, she’s a respected blogs music producer having a concentrate on the a house vertical.

To buy a residential property is an aspiration for the majority of, yet not usually one that is easily financially you can. not, for people who actually have a home you could cash-out some of the collateral even though you will be nevertheless paying off your house mortgage.

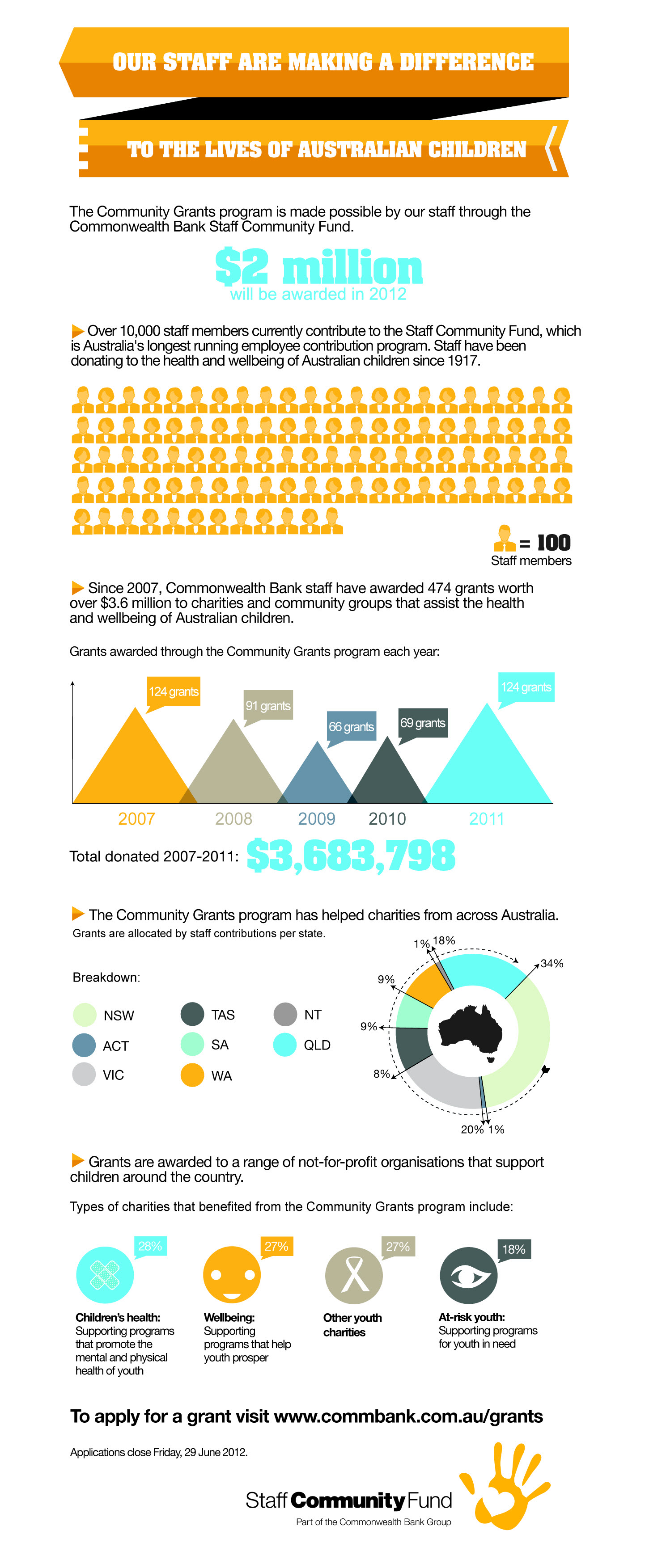

Which have costs being thus reasonable at this time, it could be a good time to consider refinancing their first the home of purchase an effective secondmonly known as cash-out refinancing, this tactic refers to that loan taken out toward a property that is already owned. Youre effectively with the family security who may have built up over 10 years to help purchase an additional domestic. There are a number of advantages and you can cons compared to that method, so is-it smart on how best to go after proper now?

Exactly how Dollars-Out Refinancing Performs

A cash-out refinancing mortgage effectively changes your current assets mortgage with a new one that’s more than the original mortgage harmony. The essential difference between the two loan amounts are withdrawn into the dollars, that trader is also lay into an advance payment with the a the fresh property.

Because you will feel withdrawing a fraction of your land guarantee within the dollars, you might be accountable for large interest rates. Simply because the loan number expanding mortgage lenders have a tendency to typically limitation how much you could withdraw in order to make sure there is however particular relocate room on equity. You will definitely only be capable withdraw to 80% of your property worthy of.

To acquire A residential property

People can build up winnings utilising the equity they enjoys in their land utilizing the cash-out total buy a residential property. With regards to the worth of your existing home loan, you can use the fresh new 80% collateral financing you can withdraw out of your possessions to get forward a down-payment towards accommodations assets which could features self-confident Bang for your buck throughout the get go.

But what makes that one something buyers should be offered? A cash out re-finance can provide the brand new trader that have a far greater interest rate than simply a primary mortgage perform, while cost was lower like they are at this time, it may be practical to pursue. With respect to taxation, the attention into the cash-out financing is actually deductible, once the are numerous of your own closing costs you would run into.

One of the most notable benefits associated with home security approach was speed. Rather than being forced to anticipate months or decades, new individual can easily gain access to money they want to snag much.

Crucial Factors

Whenever calling their lending company on the a cash out refi, there are several considerations you’re going to have to think about first. Conventional Loan providers will always be require you to continue certain part of equity on your very first possessions if the markets otherwise worth of fundamentally shed.

Buying accommodations property with this particular brand of financial support are an effective brief procedure that makes it possible to personal reduced. For those who currently have one minute assets bought making use of your own loans, you can utilize a profit-out refinance mortgage so you can redesign they.

It is very worthy of detailing there is the very least credit rating required whenever applying for a cash-out refinance mortgage. To phrase it differently, there aren’t any sheer guarantees your loan could be provided, but if your credit score are match, its highly likely that the application would be acknowledged.

The primary reason to utilize a cash out refi to invest in the second house is because it is among the cheapest different financial obligation offered to really homeowners.

In the place of loans, signature loans and hard money finance, the pace which have a profit-away home mortgage refinance loan shall be similar to the first rate of interest offered on the family.

At the same time, the money away approach makes you exploit most of the untapped security of your property, without being taxed having performing this. It is some time particularly offering a portion of your home, however, in the place of running into financing progress tax.

Lastly, since you have an official connection with their lender otherwise financial institution, there can be not as administrator associated with a funds-aside refi than a totally brand new home financing.

Makes you availableness really sensible debt Enables you to leverage the effectiveness of family appreciation You don’t get taxed for the security which you utilize You can make use of the money in order to pick another house otherwise accommodations property There can be good lot less admin inside it than simply obtaining another mortgage

Dangers of Refinancing

Refinancing are going to be dicey if you don’t approached in the right way. Whether your individual is using a cash out re-finance towards the good first assets which is nonetheless significantly less than a mortgage, financing the second family can cause these to dump both in the event the they fall behind on the loan repayments. If put like this, cash-out refinance finance can present the possibility of owing a lot more in your original property than it is actually well worth.

It is additionally vital to remember that rates of interest about this sort of of funding are going to be large and even increase throughout the years. Try to be sure to have enough money available to cover a heightened mortgage repayment per month. When the one thing were to apply to your revenue, including unexpected jobless, you can clean out each other disregard the possessions and your first domestic.

Cashing aside security in a single property so you can hold the acquisition of one minute is a practicable substitute for new buyer you to definitely means the situation carefully. While there are a few threats, whenever treated the right way, there are also high benefits and with costs at its lowest, there’s absolutely no most readily useful time for you to think cash out refinancing. Out of much more flexible terms and you will interest levels in order to income tax benefits and you may a whole lot more, buyers should consider this tactic whenever they should generate wide range having a residential property.